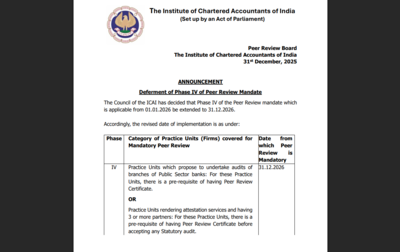

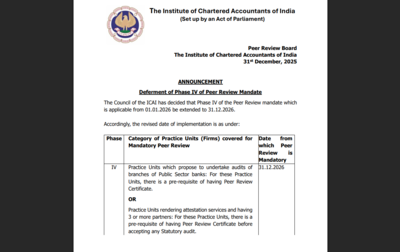

ICAI extends phase IV of peer review mandate by one year: Check details here

The Institute of Chartered Accountants of India (ICAI) has formally deferred the implementation of Phase IV of its Peer Review Mandate by one year. The phase, which was earlier scheduled to take effect from January 1, 2026, will now be implemented from December 31, 2026. The decision was communicated through an official announcement issued by the Peer Review Board on December 31, 2025.The extension brings temporary relief to several chartered accountancy firms that were preparing to comply with the new requirements at the start of 2026. It also signals ICAI’s intent to allow additional time for readiness and alignment with the peer review framework.

Background of the peer review mandate

The Peer Review system was introduced by ICAI to ensure that accounting and audit services meet prescribed professional standards. It aims to improve the quality of attestation and audit services by evaluating whether practice units follow established norms, procedures, and ethical guidelines.Over the years, ICAI has implemented the mandate in phases, gradually expanding its scope to cover more categories of firms. Each phase has brought additional segments of the profession under mandatory peer review, making compliance a key professional requirement.

What phase IV covers

Phase IV of the Peer Review Mandate applies to two major categories of practice units. The first category includes firms that propose to undertake audits of branches of Public Sector banks. For these firms, holding a valid Peer Review Certificate is a mandatory pre-condition before accepting or continuing such audits.The second category includes practice units that render attestation services and have three or more partners. These firms must obtain a Peer Review Certificate before accepting any statutory audit assignment.Both categories were initially expected to comply with the mandate from January 1, 2026.

Revised timeline and official decision

According to the official notice issued by ICAI, the Council has decided to extend the effective date of Phase IV by exactly one year. The revised date from which peer review will become mandatory for Phase IV firms is December 31, 2026.The notice clarified that the extension applies uniformly to all practice units covered under Phase IV. Until the revised date, the existing peer review framework and earlier phases will continue to operate without change.

Why the extension matters

The deferment provides additional time for firms to complete the peer review process, which involves documentation, compliance checks, and interaction with peer reviewers. Many small and mid-sized firms had expressed concerns about readiness, especially those seeking to enter Public Sector bank audits or expand statutory audit work.Peer review is not a one-day exercise. It requires preparation, internal review of systems, and alignment with ICAI standards. The extended timeline reduces immediate pressure and allows firms to plan compliance in a more structured manner.

Implications for Chartered Accountancy firms

For firms planning to audit Public Sector bank branches, the extension means they can continue preparations without the risk of immediate disqualification due to the absence of a Peer Review Certificate. Similarly, multi-partner firms offering attestation services gain more time to meet eligibility conditions before taking up statutory audits.However, ICAI has not relaxed the requirement itself. The extension only shifts the deadline. Firms will still need to obtain peer review certification before the revised implementation date to remain eligible under Phase IV.

What firms should do next

ICAI has advised practice units to use the extended period effectively. Firms are expected to initiate or complete the peer review process well before December 2026 to avoid last-minute compliance issues.The deferment offers breathing space, but it also serves as a clear signal that Phase IV will be enforced. For chartered accountancy firms, early preparation remains essential to ensure uninterrupted professional practice once the mandate comes into force.Check the official notice of ICAI CA phase 4 peer review deferment here.