All roads lead to Dalal Street: 2025 was year of IPOs; 2026 set to be bigger

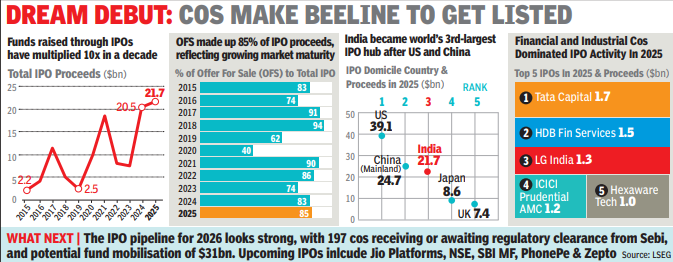

MUMBAI: Dalal Street is preparing for what could be its biggest year in the primary market, with 2026 expected to be a record-breaker for IPOs.About 197 companies have either received regulatory clearance or are awaiting approval from Sebi, representing potential fund mobilisation of around $31 billion.This builds on a strong 2025, when companies raised $22 billion through first-time share sales, making India the world’s third-largest IPO hub after China and the US. According to LSEG data, India came close to matching China’s $25-billion IPO proceeds, while remaining behind the US, which led with $39 billion.Jio Platforms is expected to spearhead the next wave of mega IPOs, potentially raising over $6 billion by selling a small stake – a deal that would make it India’s largest-ever listing. Other names anticipated to test investor appetite include NSE, SBI Mutual Fund, PhonePe, Flipkart, Oyo, Zepto, boAt, Kent RO and Curefoods. The 2026 IPO cycle is expected to revolve around three major themes – digital economy platforms, financial infrastructure, and scaled consumer businesses. In contrast, financials and industrials dominated IPO activity in 2025, LSEG data showed.“2026 may prove to be a landmark period that could redefine India’s capital market benchmarks,” said Vikas Khattar, head of equity markets at Ambit.“The market is transitioning to a ‘new normal’ where annual IPO issuances are expected to structurally stay around $20 billion, supported by deep domestic liquidity and macroeconomic stability.”Abhishek Joshi, head of equity markets at UBS India, echoed the optimism: “Given where things stand, 2026 could break IPO records of 2025. We could see IPO issuance of $20 billion-plus for the next few years,” he said.

Dream debut

Khaitan & Co partner Abhimanyu Bhattacharya added that the 2026 pipeline is “arguably stronger” than in 2025. “The ‘growth at all costs’ narrative is now muted. Fundraising will be dominated by companies demonstrating a clear path to profitability and reasonable pricing,” he said.Khattar also noted a shift in investor preferences. “The market is moving away from cash-burning discovery stories toward businesses demonstrating credible profitability,” he said.Offers for sale (OFS) dominated recent IPOs, accounting for 85% of the $22 billion raised in 2025, according to LSEG. “In previous cycles, an IPO was a way for a company to get money to survive. That thinking has shifted,” Khattar said. “Most issuers not looking for fresh capital are firms that are operationally scaled and profitable, making their IPOs liquidity events rather than fundraisers. Large OFS is a sign of maturity, not a lack of confidence.“Joshi added private equity’s rapid growth has helped companies scale, with capital markets now offering enough liquidity for PE exits while giving public investors access to these firms.2025 listings were mixed, underscoring Bhattacharya’s view that leaving money on the table is essential, with 2026 favoring performance-based pricing over perfection.