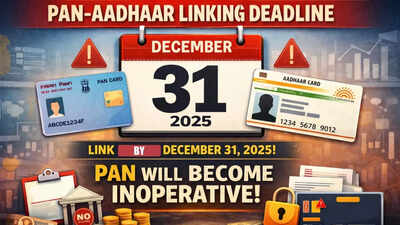

PAN-Aadhaar link status: How to check if your PAN is linked to Aadhaar, what to do if it’s not & what happens if you miss December 31, 2025 deadline?

PAN-Aadhaar link status update: December 31, 2025 is the deadline for linking your PAN card with your Aadhaar card – an important step if you don’t want your PAN card to become inoperative. The Income Tax Department has again appealed to PAN holders to complete the mandatory linking of PAN with Aadhaar. Taxpayers who miss this December 31, 2025 deadline face the risk of their PAN being rendered inoperative. With the cutoff date for PAN Aadhaar linking drawing closer, individuals who fail to complete the process may find their PAN rendered “inoperative” from January 1, 2026, according to an ET report. Such a situation can create hurdles in filing income tax returns, receiving refunds and carrying out routine financial transactions.The Income Tax Department has warned that an inactive PAN cannot be used for key financial transactions or tax related purposes, underscoring the need to finish the process before the year ends.

PAN-Aadhaar Linking: How To Link Your PAN With Aadhaar Card

Taxpayers can complete the PAN Aadhaar linking by following these steps:

- Log in to the income tax e-filing portal (https://www.incometax.gov.in/iec/foportal/)

- Navigate to the profile section and select the option to link your PAN with Aadhaar

- Enter your PAN and Aadhaar details, then choose the option to proceed with payment through e-pay tax

- Select the applicable assessment year and choose “Other Receipts” as the payment category

- Verify the pre-filled payable amount and click on continue

- Generate the challan and make the payment through your bank’s portal

- Once payment is successful, return to the e-filing portal to finalise the linking process

- Enter your PAN, Aadhaar number and name exactly as recorded in Aadhaar, then click on “Validate”

- An OTP will be sent to your mobile number registered with Aadhaar; enter the OTP to proceed

- Submit the request to finish the linking process

Once you submit the request to link PAN with Aadhaar and the payment, if applicable, is reflected, the verification generally moves quickly. The Income Tax Department forwards the details to UIDAI for validation. You can recheck the linkage status after a day or two to confirm that the process has been completed successfully, the ET report said.

Is your PAN linked to your Aadhaar? How To Verify

To check whether PAN and Aadhaar are already linked follow these steps:

- Visit the income tax e-filing portal

- Click on the option to check Aadhaar link status

- Enter your PAN and Aadhaar card details

- Submit the information to view the status displayed on the screen

How to checking PAN-Aadhaar link status via SMSYou can also confirm the linkage through a text message. Type UID PAN 12 digit Aadhaar number 10 digit PAN number and send it to 567678 or 56161. For instance: UID PAN 34512349891 CFIED1234JWhat to do if your PAN and Aadhaar card details do not matchIf discrepancies exist between PAN and Aadhaar records, you can take the following steps:

- Correct your Aadhaar details through the UIDAI portal

- Update your PAN information via Protean (NSDL) or UTIITSL

- If problems persist, opt for biometric verification at authorised PAN service centres

PAN-Aadhaar linking FAQs:

What if I miss the deadline for linking my PAN with Aadhaar Card?The Income Tax Department has made it clear that PAN card holders who do not complete the Aadhaar linkage by December 31, 2025 will find their PAN becoming inoperative. This means that the PAN card cannot be used for a range of financial and tax related purposes. This includes filing income tax returns and undertaking transactions where PAN details are mandatory.What is the penalty if PAN and Aadhaar are not linked?December 31, 2025, is the final date to link PAN with Aadhaar. Individuals who have not completed the process by now are required to pay a penalty of Rs 1,000 before proceeding with the linkage.That said, certain PAN holders have been granted relief from this charge. PAN cards issued after October 1, 2024, using an Aadhaar enrolment ID are exempt from the late fee. Such PAN holders can complete the PAN Aadhaar linking without any charge up to the deadline.The tax department has reiterated that Aadhaar linkage is compulsory for eligible PAN holders.“For existing PAN holders, who were allotted PAN on or before 01-07-2017 it is mandatory to link PAN with Aadhaar. The Link Aadhaar service is available to individual taxpayers (both registered and unregistered on e-Filing Portal),” the official income tax website reads.What does an inoperative PAN card mean?A PAN marked as inoperative can severely disrupt your financial and tax-related activities. In such cases, you will be unable to file income tax returns, and any refunds due will not be processed, according to the ET report. In addition, higher rates of TDS and TCS will apply. Carrying out key financial transactions, such as opening a bank account or investing in securities where quoting PAN is mandatory, may also become difficult, the report said.