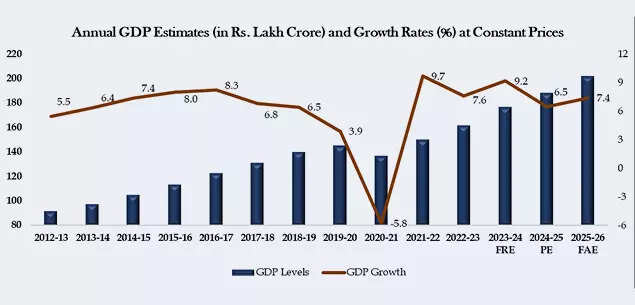

Robust economy! India’s GDP growth projected at 7.4% in FY26 – government releases first advanced estimates

[ad_1]

India’s economy will grow at a robust 7.4% in the financial year 2025-26, according to the first advanced estimates of Gross Domestic Product released by the National Statistics Office (NSO). This is much higher than the 6.5% growth in the previous financial year. Nominal GDP is expected to rise by 8.0% in FY 2025-26.Strong momentum in the services sector is estimated to be the main contributor to real GVA growth of 7.3% in FY 2025-26. Within the tertiary sector, Financial, Real Estate and Professional Services along with Public Administration, Defence and Other Services are projected to post robust growth of 9.9 percent at constant prices in FY 2025-26.Output in Trade, Hotels, Transport, Communication and Broadcasting-related services is estimated to increase by 7.5 percent at constant prices during FY 2025-26. Manufacturing and construction activities in the secondary sector are forecast to grow by 7.0 percent at constant prices in FY 2025-26.The agriculture and allied sector is expected to record moderate GVA growth of 3.1 percent, while electricity, gas, water supply and other utility services are projected to grow by 2.1 percent at constant prices in FY 2025-26.Real private final consumption expenditure is estimated to rise by 7.0 percent during FY 2025-26. Gross fixed capital formation is projected to grow by 7.8 percent at constant prices in FY 2025-26, improving from a 7.1 percent expansion in the previous financial year.

India GDP & GDP Growth estimates

In its recent monetary policy review, the Reserve Bank of India (RBI) had estimated that GDP will grow at a robust 7.3% in FY 2025-26. According to the RBI, high-frequency indicators suggest that domestic economic activity is holding up in Q3, although there are some emerging signs of weakness in few leading indicators. “GST rationalisation and festival-related spending supported domestic demand during October-November. Rural demand continues to be robust while urban demand is recovering steadily. Investment activity remains healthy with private investment gaining steam on the back of expansion in non-food bank credit, and high capacity utilisation. Merchandise exports declined sharply in October amid subdued external demand, accompanied by softer services exports. On the supply side, agricultural growth is supported by healthy kharif crop production, higher reservoir levels and better rabi crop sowing. Manufacturing activity continues to improve, while the services sector is maintaining a steady pace,” RBI governor Sanjay Malhotra said.Looking forward, several domestic drivers are expected to underpin economic performance, including positive agricultural prospects, the ongoing benefits of GST rationalisation, low inflation, sound balance sheets across corporates and financial institutions, and accommodative monetary and financial conditions, RBI said.Continued reform measures are also likely to provide additional support to growth. Externally, services exports are expected to stay resilient, although merchandise exports may continue to face challenges. While global uncertainties remain a downside risk, the swift completion of ongoing trade and investment negotiations could offer upside opportunities. “Taking all these factors into consideration, real GDP growth for 2025-26 is projected at 7.3 per cent, with Q3 at 7.0 per cent; and Q4 at 6.5 per cent. Real GDP growth for Q1:2026-27 is projected at 6.7 per cent and Q2 at 6.8 per cent. The risks are evenly balanced,” RBI said.

[ad_2]

Source link