No immediate impact seen on India’s oil supplies, prices

[ad_1]

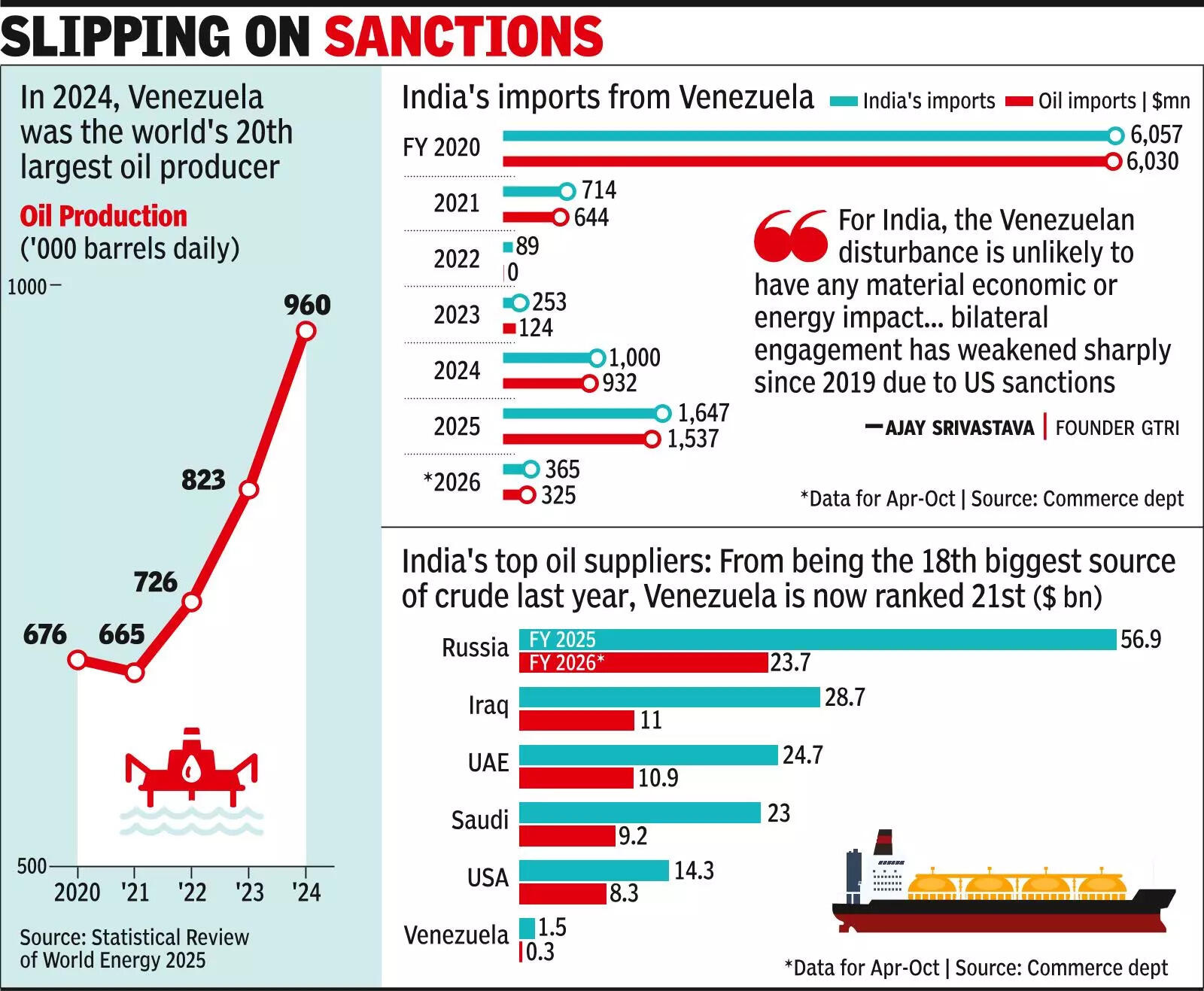

New Delhi: The developments in Venezuela will not have an immediate bearing on India’s oil supplies or prices but may open the doors to diversified sources in case the US can assert its supremacy in the South American country.To begin with, the US-led sanctions on Venezuela have meant that oil flowing into the global markets, including India, has come down. Last year, Venezuela was the 18th biggest source of crude petroleum for India, and so far this year it is placed 21st with overall imports during April-Oct pegged at a little over $300 million. With developments still unfolding, govt officials said they are not looking too much into the future. “We don’t know how things play out but there is no immediate impact on our supply,” an official said.

Experts too agreed. “For India, the Venezuelan disturbance is unlikely to have any material economic or energy impact. Although India was a major buyer of Venezuelan crude in the 2000s and 2010s, and Indian firms such as ONGC Videsh held upstream stakes in the Orinoco belt, bilateral engagement has weakened sharply since 2019 due to US sanctions, which forced India to cut oil imports and scale back commercial activity to avoid secondary sanctions,” said Ajay Srivastava, founder of think tank GTRI.Gaura Sengupta, chief economist at IDFC First Bank, said that though Venezuelan oil has been out of the global supply and India also doesn’t import much from Venezuela, it could still have a sentimental impact on the markets leading to further volatility in emerging market currencies and the rupee. “Though India’s current account deficit has been low this fiscal due to front loading of exports, yet it is another significant event after the high US tariffs. As of now, we don’t see an impact on retail fuel inflation. Hence, if and when Venezuelan oil comes to the market, Indian oil companies should take advantage and diversify,” she added.Prashant Vashisht, senior VP at Icra Ratings, said the short-term impact of the crisis on oil market may not be much as the Venezuelan crude has been out of the global market for quite some time due to the sanctions and their oil exports have fallen considerably.Venezuela is said to have the world’s largest oil reserves (17%) but output is low: it was the 20th largest producer of crude last year. Low investments have seen its production slip from the peak of around 2 million barrels a day to around a million barrels, which was around 1% of global output. Between 2014 and 2024, production fell 10%, according to Energy Institute data. Any significant increase in output will require major investments in the oil infrastructure in Venezuela.

[ad_2]

Source link