Weathering the storm: From 50% Trump tariffs to new FTAs – how India steered through turbulent trade waters in 2025

2025 has cemented itself as the year of the “Tariff Wall.” With India now facing a new landscape of protectionism from the West, and complicated energy issues developing in the global energy market, India’s economic relationship with the world has been defined by a series of flashpoints.Although government officials say that India’s external sector remains strong, a closer look at the numbers shows a complicated network that will shape the economy in 2026.From the corridors of Washington to the ports of Vladivostok, here is the state of India’s trade map.

Trade Dynamics Decoded

US: Trump 2.0

India’s “strategic partnership” with the United States is facing one of its most complex economic phases, even as political engagement remains publicly cordial. Government sources continue to underline Prime Minister Narendra Modi’s working relationship with US President Donald Trump as strong, but trade negotiations are not progressing swiftly amid tariff pressure, market-access demands, and immigration linkages. Currently, India faces tariffs of up to 50%, being in one of the highest set of tariffed countries.What began as a US push to narrow its trade deficit with India has gradually widened into a broader economic and geopolitical confrontation. While Washington initially framed tariffs as a response to trade imbalance, it soon became about India’s continued engagement with Russia, which has hardened the US negotiating posture.Trade Deficit: The original triggerThe US initially claimed its widening trade deficit with India as a key concern, arguing that India maintains relatively high tariffs on American goods and imposes restrictions that constrain US access to the Indian market. We “we have a massive trade deficit with India” Trump had said right before the initial 25 per cent tariffs came to effect in August.The Russia complexityIndia’s purchases of discounted Russian crude are no longer just a diplomatic irritant; they have become a direct economic pressure point in India–US trade talks.Indian officials have consistently defended Russian oil imports as essential for energy security and inflation management, especially amid global price volatility following the Ukraine war.However, under Trump’s 2nd term, Washington has explicitly linked India’s Russia trade to punitive economic measures, levying additional tariffs of up to 25 per cent (over the initial 25 per cent) on Indian exports to the US.This marks a clear shift:

- Earlier: Trade deficit and market access were the stated reasons for tariffs

- Now: Strategic alignment on Russia has become an unstated condition for trade flexibility.

In effect, Russia has become the shadow looming in India–US trade talks.Also read: Donald Trump’s tariff gamble: Who blinked, who pushed back & did it ‘make America great again’?Immigration & trade roomTrade talks have become entangled with immigration policy with the H-1B visa fee increased to $100,000 and more stringent compliance requirements. H-1B and H-4 visa applicants have to face mandatory social media screening. It is anticipated that these changes will negatively affect India’s largest & fastest growing means of supplying services to America: the IT industry, among other things.From New Delhi’s perspective, professional mobility is an important aspect of the bilateral trade in services.Defence dealsIndia has expanded defence procurement from the US, positioning such deals as confidence-building measures. India and the US signed an expansive new defence framework aimed at strengthening their strategic partnership over the next decade, as reported last month. The ‘Framework for the US–India Major Defence Partnership’ was inked during a meeting between Defence Minister Rajnath Singh and his US counterpart, Pete Hegseth, on the sidelines of the ASEAN meet in Kuala Lumpur. “The framework will usher in a new era in our already strong defence partnership. It is a signal of our growing strategic convergence and will herald a new decade of partnership. Defence will remain the major pillar of our bilateral relations,” said defence minister Rajnath Singh, while signing the deal.However, there has been no indication that such a deal would impact the trade deadlock between the two nations.Situation nowNegotiations remain open, but there is no major breakthrough. Tariffs, immigration, energy choices, and geopolitics are now part of a single negotiating matrix.Negotiations are happening with the commerce ministry and other officials indicating that a deal could happen soon but nothing concrete has been revealed yet. A formal round of talks was held earlier this month after previous rounds did not result in any key agreements.

Mexico: The 50% shock

A big shock came not from a superpower, but from Mexico. In a bid to stop Chinese trans-shipments from entering the US duty-free, Mexico imposed a blanket of up to 50% tariff hike on imports from non-FTA countries in December.Impact

- The hike hits 75% of India’s exports to Mexico, a market that has grown to over $5 billion. “Nearly 75% of India’s $5.75 billion exports to Mexico will be affected as tariffs jump from 0-15% to around 35%,” think-tank GTRI said.

- Mexico will impose duties ranging from 5% to 50%, with India’s largest export categories namely- automobiles and auto components—bearing the brunt.

- Passenger vehicles valued at $938.35 million will see tariffs rise from 20% to 35%, while auto components worth $507.26 million will face duties of 35%, up from the current 10–15%. Motorcycle exports, valued at $390.25 million, will also be hit with a 35% levy, ANI reported.

Situation nowCommerce Ministry officials are currently in “urgent consultations” with Mexico City. The proposal on the table is a “Country-Specific Exemption” or a limited Preferential Trade Agreement (PTA) to bypass the new wall.As India grapples with Mexico’s steep tariff hike of up to 50 per cent, an official said New Delhi is actively engaging with Mexican authorities, describing the move as a “unilateral” decision affecting a broad range of products. The official, quoted by PTI, added that discussions aim to identify mutually beneficial solutions while preserving the option to safeguard Indian exporters’ interests.

European Union: The ‘green wall’

If US protectionism is loud, the European Union’s approach is technical—and arguably more challenging. Steel and aluminium shipments face fresh hurdles as the EU’s Carbon Border Adjustment Mechanism (CBAM) moves toward full implementation from 2026, according to a Global Trade Research Initiative (GTRI) report. Initially covering steel, aluminium, cement, electricity, hydrogen, and fertilisers, CBAM is designed to align import carbon costs with those of EU-produced goods.Compliance challengesAlthough the tax has not yet been collected, Indian exports are already under pressure due to mandatory emissions reporting, introduced on October 1, 2023. Compliance difficulties, especially for small and mid-sized exporters, contributed to a 24.4 per cent drop in India’s steel and aluminium exports to the EU, falling from $7.71 billion in FY2024 to $5.82 billion in FY2025. Steel exports fell 35.1 per cent to $3.05 billion, while aluminium slipped nearly 10 per cent.CBAM adds to existing trade barriers, including safeguard quotas and anti-dumping duties. Meanwhile, India has its own Carbon Credit Trading Scheme (CCTS) as mandated by the amended Energy Conservation Act 2022 and is currently in the early stages of implementation. Given the anticipated low domestic carbon price (less than $10/tonne), when the CCTS becomes operational, this will create an additional burden on Indian exporters since they will still need to bridge the price gap with respect to the EU Emission Trading System at €65 (~$71)/tonne.Economic implicationsThe limitations of the CBAM exemption (the €150 per consignment shipment threshold and a de minimis allowance for imports <50 tonnes) were too restrictive to provide useful support for commercial consignments, according to a GTRI report. Among recommended policies include expediting the implementation of a Centralised Certificate of Origin system (CCTS), setting a clear set of sectoral benchmarks, subsidising reporting expenses for MSMEs, and developing a dedicated helpdesk for exporters. Without prompt measures to support the adoption of the CBAM, the EU’s trade deficit with India will likely expand, and ongoing EU/India trade negotiations will become increasingly complicated.Situation nowCommerce Minister Piyush Goyal announced that negotiations for a Free Trade Agreement (FTA) between India and the European Union (EU) are progressing positively. There is already an outline of the FTA which was developed during Minister Goyal’s meeting with EU Commissioner Maros Sefcovic.Both parties have issued statements indicating their strong desire to conclude the FTA as soon as possible with the understanding that there are 23 different policy areas to be negotiated regarding this FTA. These include areas related to trade in goods and services, investment, and intellectual property rights; government procurement; geographical indications; and so forth. The EU is currently the biggest trade partner for India in terms of trade with goods, with total bilateral trade between these two economies amounting to $136.53 billion in 2024-2025, of which exports from India accounted for $75.85 billion and imports from the EU were recorded at $60.68 billion.If completed, the FTA should help increase India’s competitiveness in exporting products such as ready made garments, pharmaceuticals, steel, petroleum products, electrical machinery, and more, as well as provide India with an additional opportunity to respond to questions related to the carbon-border adjustment mechanism (CBAM) and other non-tariff trade barriers.

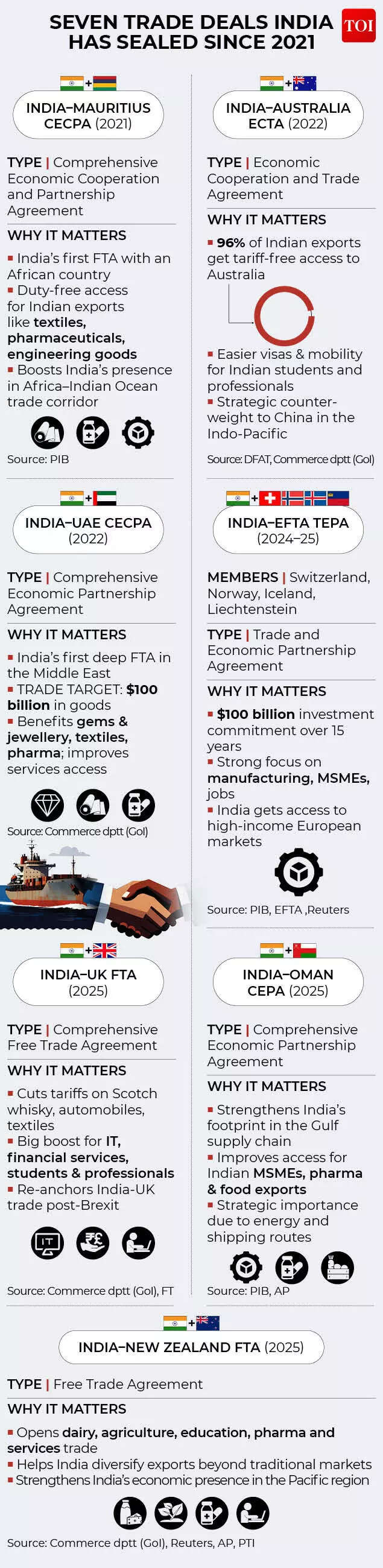

FTAs announced

United Kingdom: A calibrated breakthrough

The India–UK Free Trade Agreement (FTA) signed in July this year, represents a structural shift in bilateral commerce rather than a headline-driven political bargain. Signed during Prime Minister Narendra Modi’s visit to the UK in July.Greater access to UK marketsFor India, the agreement delivers substantial market access gains. Nearly 99 per cent of Indian exports will receive duty-free access to the UK, covering almost the entire trade value. Labour-intensive sectors such as textiles, leather, footwear, gems and jewellery, marine products, engineering goods, auto components, toys and organic chemicals are expected to benefit most, reinforcing employment generation and export diversification.On the import side, India has committed to tariff reductions across 90 per cent of tariff lines, with 85 per cent becoming fully tariff-free within ten years. This is expected to lower input costs for Indian industry, particularly in advanced machinery, medical devices, aerospace components and other capital goods that support domestic manufacturing and value-added production.The whisky and luxury cars concessionThe most visible element of the deal is the phased reduction in duties on Scotch whisky. Import tariffs will fall from 150 per cent to 75 per cent immediately, with a further reduction to 40 per cent over a ten-year implementation period. While this strengthens the competitive position of British whisky producers in India, the impact is concentrated in the premium and mid-premium segments and forms part of a broader tariff rationalisation that also covers automobiles (under a quota framework), cosmetics, soft drinks and specialised food products.The pact also paves the way for a sharp reduction in customs tariffs from levels above 100 per cent to as low as 10 per cent over time. The concessions primarily benefit ultra-luxury internal combustion engine vehicles from brands such as Jaguar and Land Rover, Rolls-Royce, Bentley and Aston Martin, with tariff cuts applied within a quota-based framework to protect domestic manufacturers. For large-engine petrol cars above 3,000 cc and diesel vehicles over 2,500 cc, duties will be progressively lowered to 10 per cent over 15 years under a quota that begins at 10,000 units and rises to 19,000 units by year five, while mid-sized and smaller cars will see similar phased reductions. Vehicles imported beyond these quotas will continue to attract steep tariffs, ensuring controlled market access while marking India’s first-ever auto tariff concession under an FTA.Services, mobility and cost reliefIn services, the FTA improves predictability and operating conditions for Indian firms in IT/ITeS, financial services, consulting and other professional services, alongside assurances on digital service delivery.A key commercial gain is the three-year waiver on social security contributions under the Double Contribution Convention for Indian professionals temporarily working in the UK, reducing costs for Indian service providers and enhancing their competitiveness. The agreement also facilitates smoother movement for defined business-linked categories — including contractual service suppliers, business visitors, investors, intra-corporate transferees and certain independent professionals — without altering overall migration policy.Business momentum buildsBusiness sentiment has shifted decisively following the signing of the pact. Grant Thornton’s International Business Report shows that 72 per cent of UK firms now view India as a priority market for international growth, up from 61 per cent last year. While only 28 per cent of surveyed UK companies currently operate in India, 73 per cent of those without a presence plan to enter, many within the next 12 months.Situation nowThe India–UK FTA has been signed, with British Prime Minister Keir Starmer pushing for implementation “as quickly as humanly possible.” While the pact now awaits ratification by the British Parliament, both governments are treating it as an execution-phase agreement rather than a negotiation-in-progress.Commercial momentum is building ahead of formal rollout, as UK firms are looking at India as a priority growth market.Simultaneously, Indian firms are also readying themselves for increased activity in their operations, despite the existing obstacles of regulatory complexity, foreign currency exchange controls and underdeveloped infrastructure.However, many believe that the pact will ultimately serve as a catalyst to reduce both barriers to entry and speed up the process of making business decisions. As soon as ratification has been completed, a significant increase in both trade and investment is anticipated.

New Zealand: Duty-free access with a dairy red line

India and New Zealand finalised a landmark Free Trade Agreement (FTA) aimed at deepening bilateral economic ties and expanding trade, investment, and mobility. Duty-free accessThe most significant advantage of this FTA for Indian exporters is that their exports will now enjoy zero duties charged by New Zealand across nearly all products and across many sectors. Labour-intensive industries are not the only beneficiaries; there are also several manufacturing industries benefited by this FTA, including textiles, apparel, leather and footwear, engineering, automotive, electronics, pharmaceuticals, chemicals, and many more. A large focus of this agreement is also on services and mobility, whereby New Zealand has opened a total of 118 service sectors for Indian service providers and has also agreed to provide “Most Favoured Nation” treatment for 139 services sectors. In addition, Indian students will now be able to receive post-study work visas in New Zealand for up to four years, and skilled professionals will be able to apply for temporary employment and working holiday visas. Additionally, New Zealand has committed to invest $20 billion in India over a period of 15 years, with manufacturing, infrastructure, service provision, innovation, and job creation in focus. Another important area of focus for this FTA is Agricultural Cooperation and has provided for better access to New Zealand markets for Indian exports of fruits, vegetables, coffee, spices, and processed foods, while at the same time protecting sensitive industries, including dairy, sugar, oils, and precious metals.Signs of trouble?Despite the overall positive outlook, the FTA faced internal opposition in New Zealand. Foreign Affairs Minister Winston Peters of New Zealand First criticized the deal as “neither free nor fair,” arguing that it gives too much to India, particularly on immigration, while failing to adequately protect New Zealand’s key dairy exports. Peters expressed concern that the deal was rushed without securing a parliamentary majority for approval and highlighted that New Zealand First had already rejected it internally. He emphasized that the opposition was not directed at India but reflected differences within New Zealand’s coalition government. Peters also noted that New Zealand’s past FTA negotiations with other countries followed a more cautious and measured approach.Situation nowTrade relations between India and New Zealand remain relatively small in terms of the value of the merchandise traded (approximately $1.3 billion for FY 2024-25) as well as for total trade (approximately $2.4 billion). Approximately $1.24 billion of this total was related to services only. The agreement is anticipated to greatly increase opportunities for movement, trade, and investment, as well as potentially double the amount of bilateral trade within the next five years. It is expected that the FTA will have a positive impact on farmers, micro and small enterprises, workers, students and young people across many industries. Additionally, New Zealand will gain improved access to the 1.4 billion consumers in India through this FTA.

Oman & the Gulf: The quiet success

The Middle East has emerged as one of India’s most dependable trade fronts. The India–Oman Comprehensive Economic Partnership Agreement (CEPA), signed this month in Muscat, marks a significant win in New Delhi’s trade diversification efforts.Duty-free accessUnder the pact, Oman will eliminate duties on over 98 per cent of its tariff lines, covering more than 99 per cent of India’s exports by value. This provides immediate and meaningful relief to Indian exporters across labour-intensive sectors such as textiles, gems and jewellery, leather, engineering goods, pharmaceuticals, medical devices and automobiles, where import duties currently hover around 5%.Strategic gatewayThe Oman CEPA is explicitly expansionary, being positioned as a logistics and services hub at the mouth of the Gulf. It will provide India with greater access to GCC supply chains and a more diverse range of services and investment opportunities.In addition, through India’s continuing commitment to more services, 100 per cent FDI access in Oman, and a more liberalised and enhanced mobility framework for Indian professionals, the CEPA continues to strengthen and deepen the relationship between Oman and India during a time when resilience and diversification are strategically important for both countries.Situation nowBilateral trade between India and Oman was approximately $10.5 billion in FY 2024–25, with Indian exports totalling about $4 billion to Oman and Indian imports totalling $6.54 billion from Oman. India is Oman’s third-largest export market of all GCC nations.Oman has approximately 700,000 Indians living in Oman sending nearly $2 billion remittances each year, and more than 6,000 Indian companies doing business in Oman. With CEPA anticipated to be in effect starting from Q1 of the next calendar year, this agreement further strengthens an already strong bilateral trade relationship between the two countries due to both volume and population factors.

Improving ties– but imbalances linger

Russia: The imbalanced structure

The India-Russia energy corridor continues to defy Western pressure but faces a crippling internal contradiction: a massive trade imbalance.The numbersBilateral trade between India and Russia has expanded sharply as both sides work toward a $100 billion trade target by 2030, but the relationship remains heavily skewed. In fiscal year 2024–25, India’s imports from Russia — dominated by crude oil and petroleum products — stood at roughly $63.8 billion, while Indian exports to Russia were only about $4.9 billion.Oil dependencyIndia remains heavily reliant on Russian crude oil, despite Western sanctions. In November 2025, India imported 1.77 million barrels per day (bpd) from Russia, which was a 3.4% increase over October. According to estimates, the amount of oil imported from Russia in December 2025 could reach as much as 1.5 million bpd by the end of the month, due to the high expected volumes in December exceeding 1.2 million bpd.As a result of the low prices being offered by Russia`s non-sanctioned companies to their clients in India; refiners purchasing these crude oils have displayed great interest in procuring Russian crude oil at these low prices. While some of the state-owned refiners – Indian Oil Corporation and Hindustan Petroleum Corps till today still continue buying Russian crude oil by utilizing the lower prices being offered by the non-sanctioned Russian oil producers; private refiners such as Nayara Energy have continued to purchase Russian oil.These imports have complicated India–US trade negotiations, as the Trump administration has linked tariffs to India’s energy dealings with Russia. Russian producers are using domestic swaps to ensure India continues to receive crude without breaching sanctions.Situation nowThe trend of growing bilateral trade between India and Russia is evident but lopsided. Imports from Russia surged from $5.94 billion in 2020 to $64.24 billion in 2024, led by crude oil. Crude oil has driven this increase and is now the highest proportion of the goods flowing from Russia to India.New Delhi has identified nearly 300 high-potential products, spanning engineering goods, pharmaceuticals, chemicals, agriculture, textiles, and light engineering, that could help narrow the gap. Currently India’s share of Russia’s overall imports is only 2%-3%, with particular areas of strong growth potential for India in pharmaceuticals, engineering products and agri-foods. For example, India is exporting approximately $546 million in pharmaceuticals, however, Russia’s current import demand for pharmaceuticals is $9.7 billion.The bilateral trade agenda gained further momentum during President Vladimir Putin’s December visit to India, which reinforced energy and strategic cooperation while emphasising the $100 billion trade target by 2030.

China: Headline gains, underlying volatility

India’s exports to China grew tremendously in November, with an overall growth of approximately $2.2 billion, or roughly 90 per cent from October, but there continues to be a significant level of volatility of trade relations. From April through November, India had an overall increase of approximately 33 per cent ($12.2 billion compared to $9.3 billion), however, the overall growth was concentrated within a few categories. The largest increases included Naphtha and some electronics including Printed Circuit Boards & Mobile Phone Components. However, several other major items such as Iron Ore and Shrimp have exhibited fluctuating trends based solely on the demand from China and not based on a well-planned export strategy from India.Heavy import dependenceNearly 80 per cent of India’s imports from China consist of machinery, plastics, organic chemicals and electronics and the electronics sector alone made up $38 billion worth of imports for the period January through October. The largest component of the electronics sector was mobile phone components, integrated circuits, laptops, solar modules, lithium-ion batteries and memory chips. Machinery was the second largest import (at $25.9 billion) and the remaining import categories of organic chemicals ($11.5 billion) and plastics ($6.3 billion) made up the additional 20%.WTO disputeAmid the seemingly improving ties, came a hurdle that could signal trouble in ties.China has approached the WTO over India’s tariffs and subsidies on solar cells, solar modules, and information technology products. China claims that India is giving preferential treatment to domestic manufacturing and discriminates against Chinese products.On the other hand, India recently implemented anti-dumping tariffs on certain products of Chinese origin, including cold-rolled steel, in addition to India’s ongoing plans to offer incentives for electric vehicles and battery manufacturing.Situation nowIndia’s trade deficit with China continues to widen, with an anticipated $106 billion gap in 2025, but estimates from China predict an even larger gap of $115 billion. The disparity arises mainly from the disproportionate growth rate of Indian exports, which increased by only 17.5 billion dollars, versus a tremendous increase in imports to 123.5 billion dollars that create an outsize discrepancy in India–China trading activity.Divergences between Indian and Chinese trade figures suggest that import records from one country may not reflect actual purchases by that country, implying potential under-invoicing practices. Overall, the current standing reflects a situation of narrow export gains, heavy import reliance, and structural imbalance.

2026 outlook

The data and negotiations of 2025 suggest that India’s trade strategy in 2026 will be defined less by new headline agreements and more by execution, insulation, and selective engagement. The resurgence of tariffs as a tool amongst global economies indicates that India is trading in a fragmented global trading system whereby bilateral arrangements are becoming more important than multilateral norms.The immediate priority will be to operationalise the agreements recently concluded with Oman and the UK that are aimed at achieving measurable positive export outcomes through the implementation of tariff concessions, services access and mobility provisions. These agreements will provide stabilisation to India’s largest export markets in an era of volatility.Simultaneously, the unresolved tariff exposures on the US and Mexico with respect to trade actions being driven recently by national security, nearshoring or political considerations rather than the traditional deficit arguments, creates a likelihood of engagement being tactical and focused on exemptions and carve outs or temporary relief rather than full trade reset of those markets.Taken together, 2026 is shaping up as a year of trade diversification, where success will be measured by India’s ability to defend market access, absorb regulatory shocks, and extract value from agreements already signed, in a world where trade openness is increasingly conditional and transactional.